- Investor Central Club STAX

- Posts

- 🔍 Microsoft Earnings Preview – Can $MSFT Live Up to the AI Hype?

🔍 Microsoft Earnings Preview – Can $MSFT Live Up to the AI Hype?

All eyes on Azure, Copilot, and capex. We break down what to expect from Microsoft’s Q4 earnings this week.

🧠 Microsoft (MSFT) Earnings Preview – Q4 FY25

📅 Earnings Date: Wednesday, July 30 (After Market Close)

💻 LIVE Coverage:

$WM $UNH $SOFI $PYPL $BA $UPS $SPOT $MRK $PG $V $MARA $SBUX $STX $MO $TEVA $KHC $HUM $ETSY $META $MSFT $HOOD $CVNA $LRCX $QCOM $F $ARM $CVS $RBLX $ABBV $NCLH $CCJ $MA $AAPL $AMZN $MSTR $COIN $RDDT $XOM $CVX

→ Stream 1 (Tickers for Monday/Tuesday)

→ Stream 2 (Tickers for Wednesday)

→ Stream 3 (Tuesday reports and preview for Wednesday/Thursday)

🚨 Headline Expectations

EPS: ~$3.38 (+14% YoY)

Revenue: ~$73.8–73.9B (+14% YoY)

Azure Cloud Growth: +34–35% YoY

Capex: ~ $80B for FY25, driven by AI infrastructure

“Azure remains the engine, but Microsoft must prove it can monetize AI at scale while controlling capex pressure.” — GeekWire

✅ The Bull Case

Strong AI monetization through Copilot & OpenAI integrations

Accelerated cloud adoption + enterprise IT spend rebound

Analysts from Wedbush, Mizuho, Citi all have price targets between $580–$600+

⚠️ Risk Factors (Bear Case)

Microsoft is already trading near all-time highs — any stumble could trigger downside

Capex concerns remain elevated as Microsoft aggressively builds out AI infrastructure

OpenAI exploring Google Cloud raises questions on exclusivity and long-term AI edge

📊 Option Traders Expect

Implied Move: ±4%

Range: ~$494 to $531 post-earnings

Any upside move will require positive guidance to justify the high valuation (~35x forward P/E)

🎯 Our Take

“This is a show-me quarter. Growth is expected—now it’s about margins, capex clarity, and AI leadership narrative. Can they deliver?” — STAX AI Team

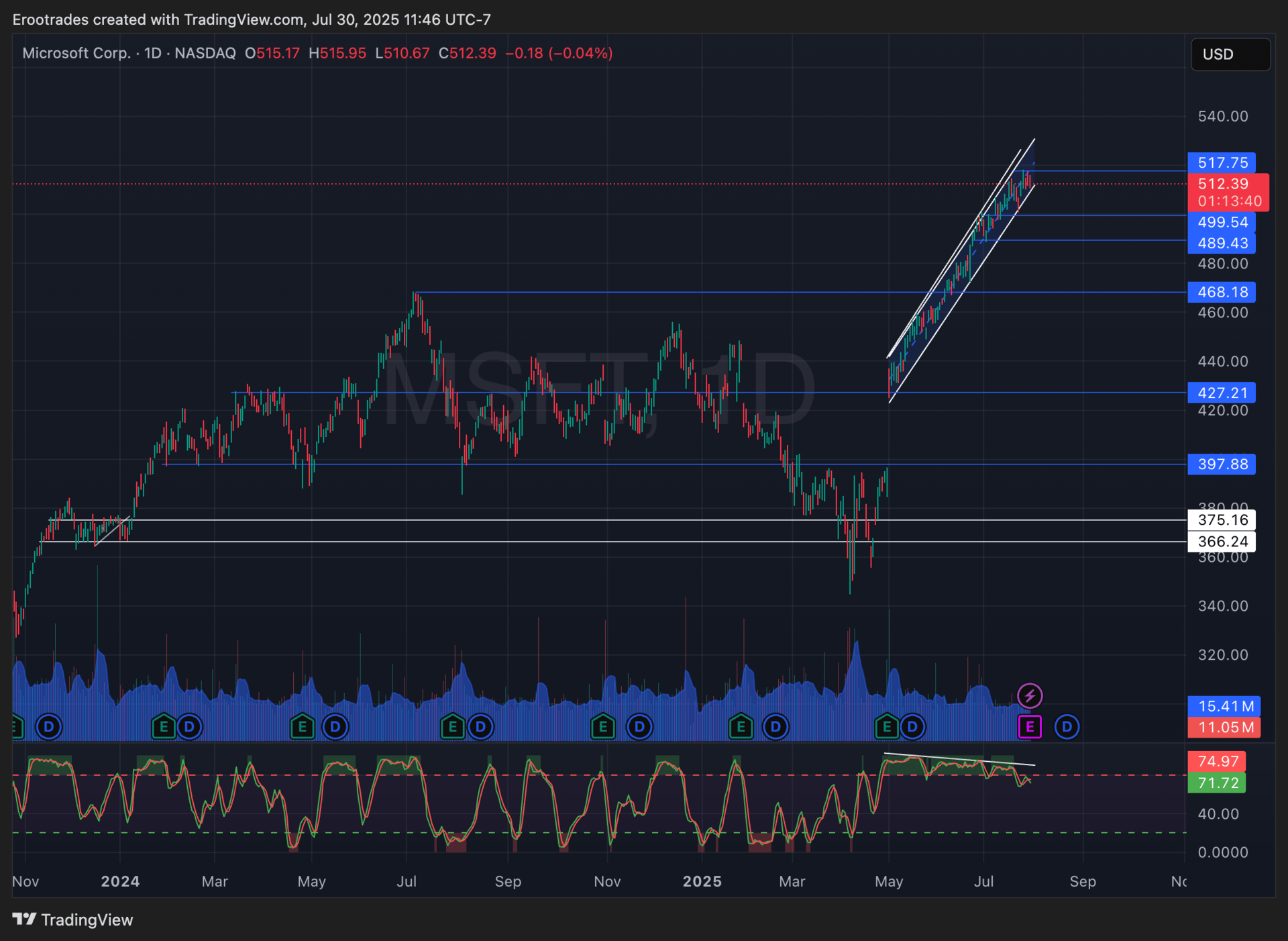

$MSFT is in a strong upward channel, a quiet climb up since the April tariff lows. Stock is up 50% from the dip. Increase in AI spending will pop this name, or are we starting to see some bearish divergence? lots of equity buys on the 18th this month, with BILLIONS spent in the $500 range Big money sentiment is mostly bullish, with shorter term expirations aiming for $510 and above

📺 Watch It With Us — LIVE

We’ll be covering the MSFT earnings as it happens, alongside breakdowns of $META, $HOOD, $CVNA, $LRCX, $QCOM, $F, $ARM, $CVS, $RBLX, $ABBV, $NCLH, $CCJ, $MA, $AAPL, $AMZN, $MSTR, $COIN, $RDDT, $XOM, $CVX:

📢 Subscribe to our YouTube Channel and hit the 🔔 notification bell so you don’t miss the rest of this week’s wild earnings lineup.

🟦 LIVE STREAM 1 SUNDAY

🟦 LIVE STREAM 2 MONDAY

🟦 LIVE STREAM 3 TUESDAY

📚 Want More Research?

🧠 STAX + ICC Discord subscribers can find full analysis in:

#eroo-trades

#tg-trades

Premium breakdowns, chart setups, and AI flow scans included.