- Investor Central Club STAX

- Posts

- 📬 Earnings Week Kickoff: Verizon ($VZ) In Focus

📬 Earnings Week Kickoff: Verizon ($VZ) In Focus

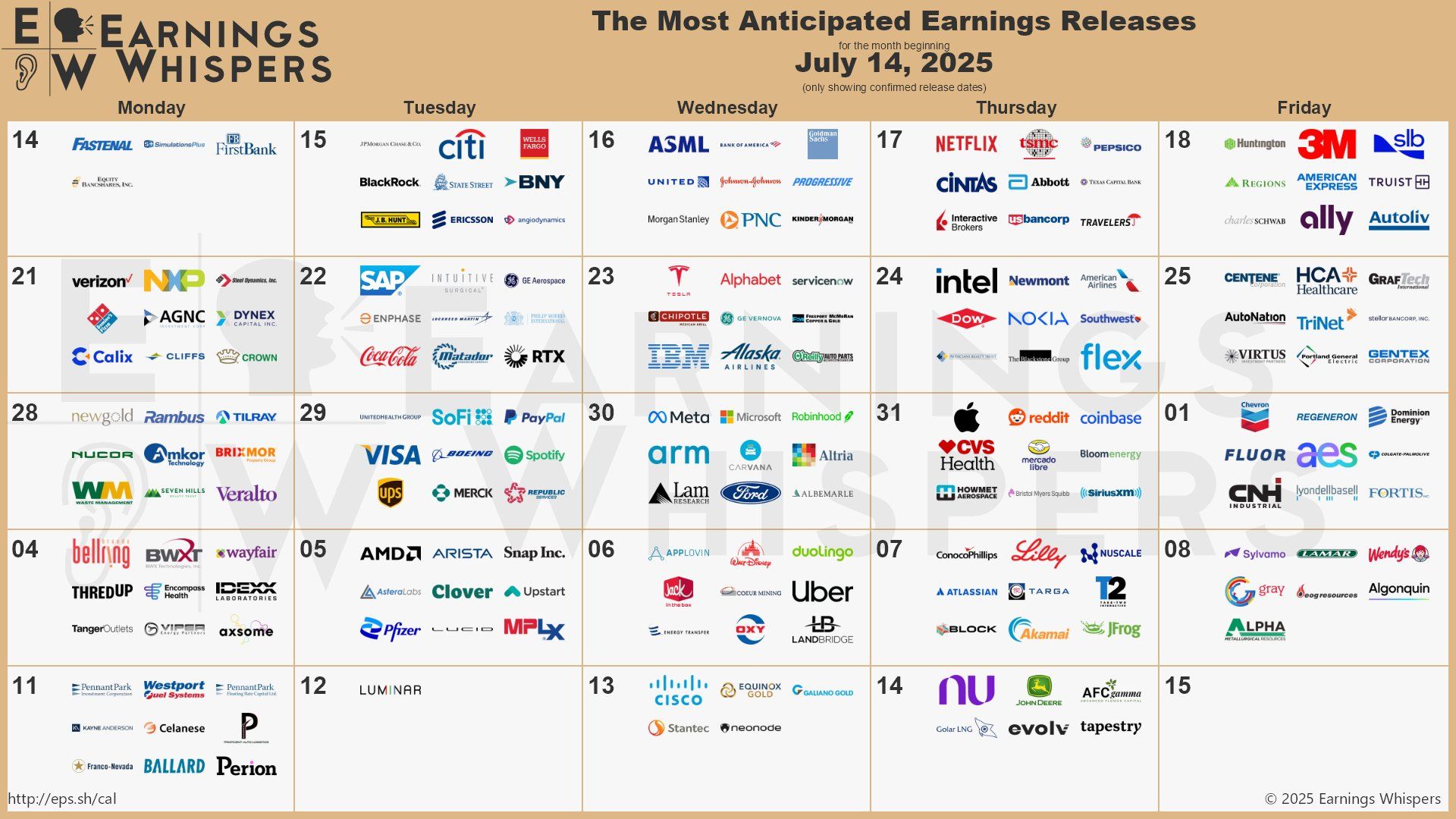

It's Earnings Season!

📬 Earnings Week Kickoff: Verizon ($VZ) In Focus

This week, we're teaming up with Trades & Gains (T&G) for a full breakdown of one of the most quietly intriguing earnings setups of the season: Verizon ($VZ).

ICC Discord and STAX users can get all our earnings analysis under the eroo-trades and tg-trades channels! We’ve already analyzed: $VZ ( ▼ 1.26% ) $GM ( ▲ 1.4% ) $KO ( ▼ 0.31% ) $EQT ( ▲ 1.66% ) $ENPH ( ▼ 2.51% ) $TXN ( ▲ 0.26% ) $NOC ( ▼ 3.31% ) $DPZ ( ▼ 2.48% ) $LMT ( ▼ 2.55% )

Our BONUS Closing Bell LIVEStream Yesterday went over many of these tickers:

It’s Earnings Season! What tickers are you looking at?

📅 Monday Earnings Preview: $VZ ( ▼ 1.26% )

Ticker: $VZ

EPS Estimate: $1.18

Revenue Estimate: $33.58B

While $VZ has been underperforming against its telecom peers, this report might just be the catalyst for a turnaround.

What We’re Watching:

📈 Broadband growth remains strong — 339K net additions last quarter

📉 Wireless competition is eating into share

💸 Still highly profitable with a strong dividend yield

⚖️ Risk vs. reward setup looks favorable for long-term investors and short-term traders alike

Dive deeper into the full analysis by T&G →

🔗 Can Big Red Dial Up a Surprise?

🔍 STAX AI Flow Insight:

STAX is quiet lately on $VZ — but here’s what we’ve seen:

🟢 $45C expiring 10/17 with $279K premium

🔴 $42P expiring 10/17 with $649K premium

These may suggest hedging or positioning ahead of a muted move — but STAX tends to light up after earnings drops, so keep your dashboard ready.

📺 Watch our full Earnings Outlook breakdown here:

➡️ YouTube: Verizon Earnings Flow & Forecast

💡 Whether you're in it for the dividends, the upside risk, or just looking for the next STAX alert — $VZ is worth a watch to start the week.

💡 Kimo’s Take: Look Deeper Into the Flow

“While the options flow leans slightly bearish on the surface, dig deeper. Look at the equity block trades. Remember, options were originally designed to hedge equity positions, not just speculate. Now line up the timestamps: both the options and equity flows show consistent activity from June and July — a strong signal that institutions are buying shares and using options as protection. Why? $VZ is a solid dividend play — perfect for funds that want steady yield while neutralizing short-term volatility with hedges. On top of that, check the insider buys this July. Insiders don’t move like funds — they have different motives, and they’ve been buying, not selling. Last note: timing isn’t everything for big money. If it were, they'd all be flagged by the SEC. What matters more is conviction — and based on everything we’re seeing, mine leans bullish.”

More earnings coverage coming soon.

— Investor Central x Trades & Gains